Ultimate Guide to Risk Management in Gold and Silver

Learn effective strategies for managing risks in gold and silver investments, including diversification, allocation, and market insights.

Learn effective strategies for managing risks in gold and silver investments, including diversification, allocation, and market insights.

Explore how silver has consistently served as a hedge against inflation and economic turmoil over the past century, revealing key investment insights.

Discover gold market trends, the impact of economic shifts, and the top stock picks for investors in 2025.

Learn how to invest in gold through ETFs, mutual funds, and digital gold options. Discover affordable alternatives to physical gold investments.

Explore how trade deficits influence gold and silver prices through currency devaluation, inflation, and economic uncertainty.

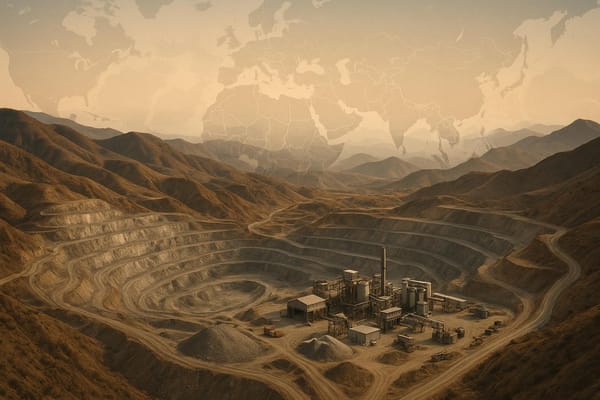

Geopolitical tensions significantly influence silver mining stocks by affecting production, investor demand, and currency fluctuations, creating both risks and opportunities.

Explore how supply constraints and shifting demand shape silver prices, driven by industrial use and investment trends amid economic fluctuations.

Explore the intricacies of vault storage fees for precious metals, including factors influencing costs and essential services provided.

Low-grade silver mining is raising costs and challenging profitability, pushing companies to innovate and adapt for survival in a volatile market.

Explore the differences between gold and currency hedging strategies to protect your investments from currency risks and inflation.

Explore how U.S. dollar fluctuations affect gold prices, investment strategies, and the complex dynamics of currency and commodity markets.

Explore how exchange rates influence gold prices, the impact of currencies, and strategies for investors navigating this dynamic market.