5 Reasons Why Gold is Valuable

1) Gold Is Rare

Compared to other metals and minerals in the Earth, gold is actually very rare. Anything that is in low supply is going to be valuable.

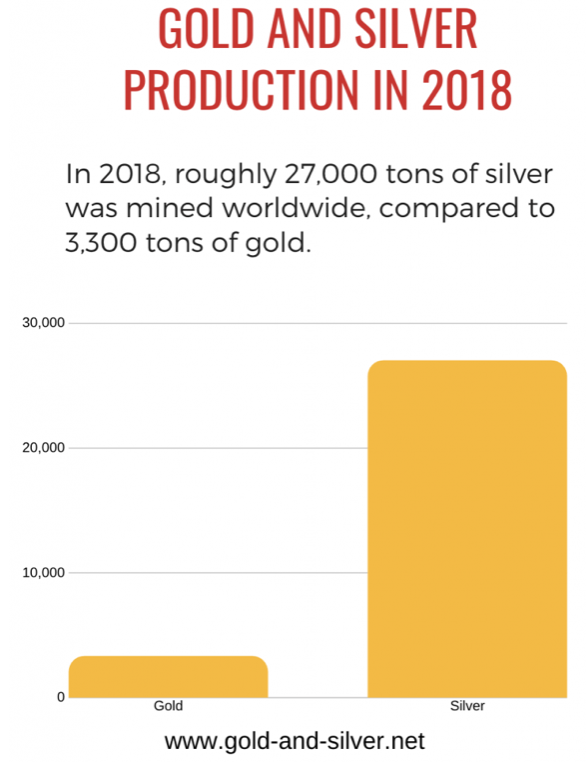

In 2018, the following quantities of gold and silver were mined:

Sources:

Worldwide above ground gold stocks increase by roughly 3000 tons every year. That is not very much! Annual silver production is roughly 27,000 tons, roughly 9 time as much silver is mined compared to gold.

Compare 3,300 tons of gold; to the 1,630,000,000 tons of steel that are created every year… and it is easy to see that gold is much rarer than other metals, leading to its value.

2) Gold is an Inert Metal

Unlike iron, gold will not rust. You can leave a gold coin buried for 100s of years, dig it up, and will still be there, shining like the day it was first minted.

Gold lasts for… well, unless it is physically destroyed, forever. This is another reason why gold is a great long term store of wealth.

If you were to bury copper coins, or paper money; they would very quickly degrade over time.

Your gold bullion is going to last forever.

3) It’s Been Recognised as Money For 1000s of Years

100 years ago, you could go into a major trading city, pay for something, and receive your change in gold coins… from all over the world. National government backed currency, on the scale that we see it today, is a relatively modern invention. Up until recently, kings and governments would mint money (i.e. stamp the kings head on a gold coin), but they would not enforce its use.

The stamp on a gold coin was a guarantee as to the weight and purity of the coin, and also made forgery a criminal offence – often punishable by death on old times. But, you could use a gold coin from anywhere… to pay for anything.

And when push comes to shove in a recession, a crises or even a war… people will take gold any day, in favour of an inflating government currency.

Currencies come and go… but a gold coin, no matter who’s face is stamped on the front, is always going to be a gold coin.

4) Gold Is a Physical Metal

You can pick it up and hold it in your hand. Gold has to be mined out of the earth.

Today, the world uses what is called “fiat currency” as a means of exchange. Fiat currency has no intrinsic value. It has value because the government enforces its use, often via taxation, or by declaring that it is illegal to use other currency as a means of exchange, or making anything else incredibly awkward to use.

The government also cycles old currency out of circulation, changing notes and coins, rendering old notes and coins invalid.

A gold coin will always be a gold coin. It will always hold its value.

5) Your Government Can’t Print Gold

Governments have a bad habit of living in a fairy tale world, where economic problems can be “solved” by printing more money. The fancy word for this is “quantitive easing”.

Every single time the government does this, it causes inflation. It erodes the value of the currency. It destroys wealth.

But your government can’t print gold. If you own gold, and the government starts printing money and causing rampant inflation… you’re safe. In fact, the purchasing power of gold will increase as the value of the government currency decreases.

Conclusion

Gold is always going to be valuable, that is never going to change. That is why it is a good idea to hold some gold bullion as a long term store of wealth.