Trump Administration’s Impact on Gold Prices – Six-Month Market Analysis

Gold Price Trends (Dec 2024 – May 2025)

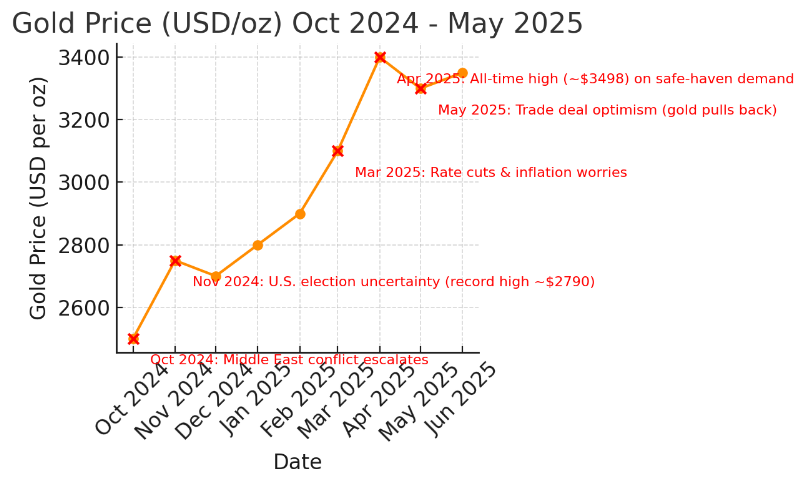

Over the past six months, gold prices have shown significant volatility with an overall upward trend. In late 2024, gold surged to record levels amid political uncertainty: by early November 2024 (just before the U.S. election), spot gold hit an all-time high of around $2,790/oz1 . After the election, prices moderated slightly but remained elevated through year-end. The rally intensified in the first months of 2025 – gold broke above the $3,000/oz threshold by March and climbed to about $3,498/oz at its peak in April 20252 . This April high marked a new record, driven by safe-haven demand and economic jitters. In May 2025, prices pulled back somewhat (dipping to ~$3,308/oz after early May) as optimism grew around international trade deals and market risks appeared to ease3 . Despite the spring correction, gold in May was still trading near historically high levels, well above its prices from six months prior.

Several distinct phases characterized gold’s performance in this period. Late 2024: Geopolitical flare- ups and U.S. election jitters sparked a flight to safety. For instance, the escalation of conflict in the Middle East (the Israel–Hamas war beginning October 2024) and fears it could broaden regionally helped drive gold above $2,600 by that autumn4 . Simultaneously, investors braced for the U.S. presidential election outcome – polls showed a contentious race – prompting heavy safe-haven buying. By the first week of November, on the eve of the vote, gold had spiked to record levels (~$2,790 1 ) as markets priced in the chance of a contested result and potential unrest. Indeed, a Reuters/Ipsos survey at the time found widespread concern about post-election turmoil, given memories of the Capitol1 unrest following Trump’s 2020 defeat1. This “risk-off” sentiment lifted gold, which is widely viewed as a hedge against political uncertainty and tends to thrive when interest rates are low1.

Early 2025: After the election, gold initially stabilized as immediate uncertainty waned, but it soon resumed its climb on emerging economic and policy signals. A pivotal factor was the outlook for inflation and interest rates. By late 2024, inflation had been easing from its early-2020s highs, and the U.S. Federal Reserve began shifting course. In fact, the Fed implemented its first rate cut in years around Q4 2024, a response to cooling inflation and perhaps to political pressure for easier money4 . Lower interest rates made non-yielding assets like gold more attractive, weakening the dollar and buoying gold prices. In parallel, the European Central Bank also cut rates moving into 2025, contributing to a softer euro and dollar devaluation, which further supported gold2. By January– February 2025, investors anticipated an easier monetary environment – a boon for gold, which rose steadily into the $2,800–$3,200 range during the winter months.

The legacy of Trump-era policies and the new political landscape also played a role in gold’s early-2025 momentum. Although Donald Trump was no longer in office throughout 2024, the possibility of his return (he was a leading candidate in the 2024 election) and the rhetoric around his agenda had tangible market effects. Investors recalled that Trump’s first term featured aggressive trade policies and deficit-fueled tax cuts, which could reignite inflation or disrupt trade if repeated. As one commodities strategist noted on the eve of the election, a Trump victory was expected to “help gold prices” because markets would worry “a little bit more about inflation with all the tariffs that he’s talking about”1. In other words, the prospect of renewed tariffs and trade conflicts under Trump’s leadership increased hedging demand for gold, since tariffs can raise import costs and inflation. Indeed, tariffs and trade tensions had already proven to be bullish for gold during Trump’s first term – bullion hit multiple record highs in the late 2010s “since Trump first announced his tariffs” on China3. This time around, mere anticipation of such policies (amid the 2024 campaign and after Trump’s win) was enough to bolster gold.

By spring 2025, with Trump’s new administration in its early days, several developments converged to push gold to its apex. Global geopolitical risks remained front and center: the Russia–Ukraine war persisted into its third year, and the Middle East situation was still unstable – factors that kept investors cautious. Central banks worldwide were also stockpiling gold at a historic pace, which added upward pressure on prices. In 2022–2023, many central banks (notably in China, Turkey, and Russia’s allies) had ramped up gold purchases to diversify reserves away from the U.S. dollar, especially after Western sanctions froze Russia’s dollar assets2 5. That trend continued into 2024 and 2025, providing a steady source of demand. By April 2025, the cumulative effect of these drivers – low real interest rates, lingering inflation concerns, geopolitical conflict, and robust central-bank buying – propelled gold to its new all-time high near $3,500/oz. Analysts described it as a “perfect storm” of economic and political factors fueling a gold rush4 5.

Late Spring 2025: After peaking in April, gold saw a pullback in May as some risks began to abate. Notably, President Trump moved to strike international deals that improved market sentiment. On May 8, 2025, the U.S. announced a “breakthrough” trade deal with the UK, easing some tariffs and hinting at progress on other trade fronts3. This development, along with hints of renewed U.S.-China trade talks, sparked hopes that global trade frictions might diminish. A reduction in trade tension tends to improve investor confidence in the economy (dampening the appeal of safe havens) and can reduce expected inflation from tariffs. Consequently, gold prices fell over 1% on the trade-deal news 3 – a modest but notable correction. By mid-May, spot gold hovered around the mid-$3,300s, off its highs but still extremely elevated historically. Traders noted that if further U.S. trade agreements materialize (for example, a truce in the U.S.–China tariff war), gold could face additional resistance and possibly retreat to the low $3,200s3. In essence, the late-spring dip underscored gold’s sensitivity to improving2 economic/political outlooks: as fears ease, some of gold’s risk premium unwinds. Even so, the metal remained in high demand, reflecting persistent undercurrents of uncertainty (from unresolved geopolitical conflicts to questions about the direction of U.S. policy).

Key Factors Driving Gold’s Moves (Inflation, Rates, Geopolitics, Sentiment)

Multiple indirect factors underpinned the gold price behavior in the last half-year. Chief among them were: inflation expectations, interest rate policy, geopolitical tensions, and overall market sentiment (especially risk aversion).

Inflation and Currency Debasement

Inflation plays a crucial role in gold pricing, as gold is often seen as a hedge against purchasing power loss. In the period in question, U.S. inflation had moderated from the peaks of 2022 (when it exceeded 8–9%) down to roughly 3% by late 20245. However, there were growing concerns that inflation could rebound due to expansive fiscal policies and potential new tariffs. The Trump administration’s legacy included large tax cuts and spending increases that expanded federal deficits, and any continuation of such policies can stoke longer-term inflation or dollar weakness. Indeed, as 2025 began, analysts were already warning that “government deficits [are] increase[ing], fiat currency debasement continues,” creating a supportive backdrop for gold5. The anticipation of Trump potentially extending his 2017 tax cuts (set to expire) or enacting new stimulus measures contributed to these worries. Additionally, Trump’s protectionist stance – such as imposing or threatening high tariffs on imports – directly feeds into inflation expectations (tariffs raise import prices). As noted, the mere talk of renewed tariffs made investors wary of future price increases1. This inflationary overtone boosted gold’s appeal as a hedge. It’s worth noting that inflation dynamics were intertwined with supply shocks from ongoing conflicts (e.g. energy and food cost pressures from the Ukraine war) and with currency dynamics – as U.S. inflation outpaced other nations in previous years, the dollar’s strength wavered, pushing some investors toward gold. In summary, while headline inflation had cooled by early 2025, inflation expectations were kept alive by expansive fiscal/trade policies and war-related supply risks, helping sustain gold’s rise.

Interest Rates and Monetary Policy

The direction of interest rates was a critical driver for gold in this period. Throughout 2022–2023, the U.S. Fed and other central banks had aggressively hiked rates to combat inflation, creating a headwind for gold. By late 2024, however, this trend reversed – central banks started cutting rates or signaling cuts, which dramatically improved gold’s prospects. Gold tends to perform well in low-rate environments because lower yields reduce the opportunity cost of holding gold (which yields no interest) and often put downward pressure on the dollar. In fact, the inverse correlation between gold and real yields, which had broken down during the height of rate hikes, began reasserting itself once the Fed pivoted to easing4. In November 2024, markets widely expected the Fed to begin cutting rates (and a quarter-point cut did materialize around that time)1. The anticipation of a looser monetary stance was a bullish signal for gold – as one Goldman Sachs strategist noted, once “the Fed [started] cutting rates, investors [came] jumping back in” to gold5. This dynamic was clearly visible in Q1 2025: gold’s steep climb coincided with the Fed pausing hikes and hinting at rate reductions, as well as the ECB’s actual rate cuts2. Additionally, Trump’s vocal criticism of high interest rates (a theme during his first term) and his preference for a weaker dollar created expectations that his administration would pressure the Fed toward dovish policies. Reports suggested the Fed was “under pressure from President Trump” to keep rates low in early 20252. Although the Fed is independent, such pressure reinforced investor bets on an accommodative stance. In short, the end of tight monetary policy and the beginning of rate3 relief was a key catalyst in boosting gold over the last six months. Gold’s surge to record highs in March–April 2025 directly reflected the market’s adjustment to a new era of falling real yields and renewed liquidity4.

Geopolitical Tensions and Crises

Geopolitics strongly influenced gold during this period, as global conflicts and diplomatic frictions kept risk appetite in check. Gold is a classic safe-haven asset that investors flock to in times of international crisis6, and late 2024/early 2025 saw no shortage of such crises. The ongoing war in Ukraine remained a major source of uncertainty. By sustaining a conflict in Europe, it not only spurred safe-haven demand but also drove up commodity prices (especially energy), contributing to the inflation narrative supporting gold. Likewise, the sudden war between Israel and Hamas in October 2023, and its potential to draw in neighboring countries by late 2024, injected volatility into markets. By April 2024, that conflict had escalated and was cited as a factor pushing gold to new highs4. In addition to wars, there were persistent U.S.–China tensions – partly a legacy of Trump’s first-term trade war and continued tech/trade disputes under his successor. In early 2025, relations with China were still strained, with tariffs largely still in place and strategic rivalry high. Any signs of détente (such as the mentioned trade talks in May 2025) tended to ease gold, whereas any confrontation (new tariffs or sanctions) would lift it. Beyond these, other global hotspots (North Korea’s nuclear posturing, Iran–U.S. frictions, etc.) created an ambient level of geopolitical risk. Overall, this period’s “troubled geopolitical landscape” – spanning Europe, the Middle East, and Asia – was a key pillar supporting gold prices4. Importantly, geopolitical events also had indirect effects (e.g. prompting the aforementioned central bank buying spree for gold as a safeguard2). In sum, heightened global tensions consistently translated to higher gold demand in late 2024 and early 2025.

Market Sentiment and Safe-Haven Demand

Underlying all the above factors was a prevalent tone of caution in financial markets. Even as stock markets attempted rallies at various points, investors kept a significant hedge in gold due to the uncertain sentiment. Political developments in the United States contributed here: the 2024 U.S. election cycle was exceptionally contentious and eventful, which at times rattled investors. During the campaign, unforeseen events – for example, the incumbent president (Joe Biden) withdrawing from the race and an assassination attempt on Donald Trump4 – created an atmosphere of domestic instability. Such events, alongside fears of post-election violence, made investors seek safety. Consequently, gold benefited from what could be called a “risk-induced premium” that persisted through the election and transition4. Beyond the U.S., the general backdrop of slowing global growth and uncertainty about future fiscal/monetary support kept risk appetites in check. It’s telling that even when inflation was easing (normally a positive for stocks), the “fear factor” in markets remained as strong as the “greed factor” – a psychology that always favors gold. By early 2025, many institutional investors and central banks held above-average allocations to gold, reflecting a strategic pivot toward safety2. In brief, market sentiment during this half-year was tilted toward caution, and gold’s traditional role as a safe-haven was reinforced at each bout of bad news. As an analyst at CFRA summarized, “gold will perform well in the current environment as real interest rates decline, government deficits increase, fiat currency debasement continues, and geopolitical conflicts flare-up around the world”5 – a concise description of the sentiment drivers that all converged in late 2024–25.

Lasting Influence of Trump’s Policies and Legacy

Although Donald Trump was out of office for most of the period under review (his first term ended in January 2021), the legacy of his administration’s policies – and the political climate he shaped4 –continued to exert influence on the gold market. There are several channels through which Trump’s presidency (2017–2021) cast a long shadow on gold dynamics in 2024–2025:

Trade War and Tariffs

Trump’s aggressive trade policies, especially the trade war with China initiated in 2018, fundamentally altered global trade flows and business sentiment. Many of the tariffs he imposed (on hundreds of billions of dollars of goods) remained in effect under the Biden administration. These tariffs contributed to higher input costs and persistent inflationary pressure in certain sectors, which supported gold prices. More importantly, Trump’s trade war set a precedent for using tariffs as a policy tool, so even the possibility of their return in a second Trump term made markets uneasy (as evidenced by the gold rally when Trump talked of new tariffs1). During Trump’s first term, each escalation in U.S.–China tensions corresponded with spurts of gold buying – indeed, bullion notched multiple record highs during 2019–2020 amid tariff announcements and counter-retaliations3. That pattern was fresh in investors’ minds in 2024. Thus, Trump’s legacy is that gold is now highly responsive to trade policy news. In the last six months, whenever rhetoric pointed toward renewed tariff conflicts (e.g. campaign promises of steep tariffs on imports), gold prices jumped in anticipation of the potential economic fallout. Conversely, news of easing trade tensions (like the May 2025 trade deals) saw gold ease3. In short, Trump’s approach of weaponizing tariffs left a lingering risk factor in the global economy – one that continued to drive safe-haven demand for gold whenever it resurfaced.

Fiscal Policy and Debt

Trump’s administration was marked by large tax cuts (the 2017 Tax Cuts and Jobs Act) and increased federal spending, which substantially expanded U.S. budget deficits and the national debt. By the end of Trump’s term, the U.S. debt-to-GDP ratio had climbed sharply (exacerbated by emergency COVID-19 spending in 2020). This debt overhang is part of Trump’s economic legacy that carried into the Biden years. A higher debt burden can put downward pressure on the dollar (as investors worry about long-term debasement or even the risk of default in extreme cases) and upward pressure on inflation (if deficits are financed by money creation). Gold thrives on such conditions – it is often seen as protection against currency debasement and loss of confidence in government finances5. Over the past six months, U.S. fiscal policy came back into focus with the approaching expiration of Trump’s individual tax cuts in 2025. The uncertainty over whether those tax cuts would be extended (potentially adding further to debt) or allowed to lapse created volatility in bond markets and influenced gold. Moreover, political battles over the debt ceiling (which occurred in prior years) remained a background threat. While not directly caused by Trump, the polarized climate and large debt load (partly a result of his term) made such fiscal showdowns more frequent and intense. Investors often buy gold as insurance against a U.S. fiscal crisis or a weakening dollar – and Trump’s fiscal legacy kept that calculus relevant in late 2024. In essence, Trump’s tenure normalized trillion-dollar deficits even in economic boom times, and the continuation of big deficits under his successor meant that gold’s long-term bullish narrative (as a hedge against debt- driven currency erosion) stayed intact. In early 2025, when Trump returned to the White House, markets expected more deficit-financed tax cuts or spending, which only reinforced gold’s allure.

Appointments and Regulatory Changes

Another subtle legacy of Trump’s administration is in the personnel and regulatory domain, which indirectly affected gold markets. Trump’s appointments to the Federal Reserve (including Chairman Jerome Powell) meant the Fed’s leadership throughout the 2022–2024 inflation episode was partly his selection. While Powell pursued aggressive rate hikes in 2022 to tame inflation – a stance Trump had previously criticized – by 2024 the Fed was pivoting to rate cuts, and there was speculation that a Trump- influenced Fed might cut rates faster (Trump had often advocated for near-zero rates). The perception that the Fed could be more politicized or inclined to ease policy under pressure added to gold’s strength (since easy money tends to support gold). Additionally, Trump’s1 deregulatory actions in the energy sector led to a surge in U.S. oil and gas output during his term. This increased oil supply helped keep energy prices (and inflation) somewhat in check pre-2020; however, the dismantling of some environmental regulations also had long-term implications for geopolitical stability (e.g. affecting climate trends, which can indirectly lead to conflicts or economic strain). These connections are tangential, but they underscore that policy continuity vs. reversal between administrations mattered for markets. By late 2024, the possibility of a shift back to Trump-era regulatory and foreign policies (more confrontational stance toward adversaries, less emphasis on climate cooperation, etc.) contributed to the uncertainty premium in gold. Even out of office, Trump remained a polarizing figure in U.S. politics – his continued influence on the Republican Party meant that policies in many states (and in Congress) followed his ideology, affecting everything from trade to sanctions. For example, tougher U.S. sanctions on adversaries (a hallmark of Trump’s approach) can motivate those countries to stockpile gold as a buffer – a trend observed with Russia and China increasing gold reserves amid sanctions2. Thus, Trump’s policy legacy created a feedback loop: adversaries hedged against U.S. financial power by buying gold, which in turn supported global gold demand over the past few years.

Political Polarization and Domestic Stability

Trump’s tenure saw an increase in domestic political polarization and even episodes of civil unrest (most notably the January 6, 2021 Capitol riot following his election loss). This has had a lasting impact on investor psychology. Events that would have once been seen as unthinkable – a disputed U.S. election outcome or an outright challenge to the democratic process – are now part of the risk calculus. In the last six months, as the 2024 election approached, memories of the turmoil after the 2020 election kept investors on edge1 . The atmosphere of polarization (much of it attributed to Trump’s continued claims and influence) meant that markets placed a higher probability on worst-case scenarios (such as a constitutional crisis or large-scale protests). This added a premium to gold, as prudent investors sought a hedge against political chaos. Even after the election, the U.S. remained deeply divided, which could affect everything from consumer confidence to the government’s ability to respond to crises. Trump’s role in shaping this divided landscape – and his ongoing presence in the political arena through rallies, legal challenges, and media coverage – indirectly sustained an undertone of uncertainty in 2024–25. In practical terms, when news headlines turned to political strife or contentious policy debates (e.g. fights over election legitimacy or impeachment inquiries), gold tended to get a boost. For instance, early 2025 saw contentious confirmation battles and legal disputes involving Trump and his associates, which, while unrelated to economic fundamentals, still contributed to a “wait-and-see” mood among investors. All of this highlights how Trump’s political legacy – beyond concrete policies – influenced market sentiment and thus gold demand.

In summary, Trump’s administration left an imprint on the economic and geopolitical environment that extended into the period after his first term. His policies (trade and fiscal) altered inflation and risk expectations, and his leadership style (confrontational and unpredictable) raised the risk premium that investors assign to U.S. and global stability. Over the last six months, these legacy factors were evident in the way gold reacted to news: gold rose on fears of Trump-style tariffs or deficit spending, and on any signs of political turmoil, reflecting the market’s memory of 2017–2021. Even with Trump out of power in 2024, one could argue the “Trump effect” lingered – manifesting as higher baseline demand for gold as a hedge. And once Trump was back in office in 2025, that effect became even more pronounced, as markets braced for a reprise of his prior policies (which, by most accounts, tend to favor gold’s prospects in times of uncertainty).1

Gold’s Performance Across Recent Administrations: Obama vs. Trump vs. Biden

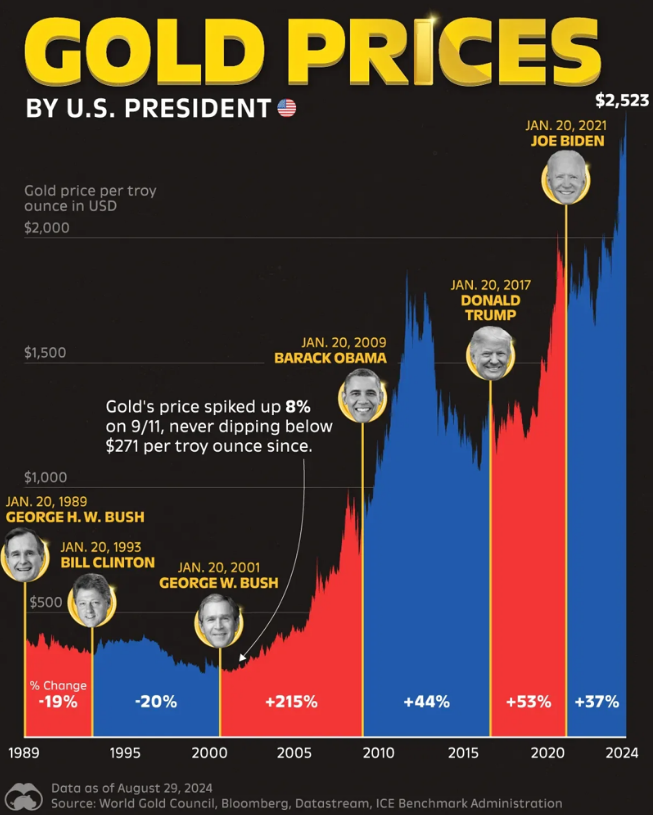

To put the latest gold price movements in context, it’s useful to compare how gold behaved under different U.S. presidencies. Gold’s long-term trajectory has been shaped by each era’s economic conditions and crises, often responding to the policies and events associated with each president. Below is a comparative overview of gold price trends across the Obama, Trump, and Biden administrations:

Barack Obama (2009–2016)

Obama inherited the 2008 financial crisis and ensuing recession as he took office. During his first term, the economy was in disarray and the Federal Reserve undertook unprecedented quantitative easing (QE) to stabilize the system. These conditions were extremely bullish for gold. Investors feared the Fed’s money-printing and near-zero rates would debase currencies and spark inflation, even as safe-haven demand was high due to economic distress4. As a result, gold soared dramatically in Obama’s early years. From around ~$800/oz in January 2009, gold rocketed to about $1,900/oz by September 2011, an increase of roughly 130% in less than three years4. This surge was also fed by global factors: the European sovereign debt crisis and U.S. debt ceiling standoffs in 2011 fueled fears of a broader financial meltdown, keeping gold demand strong4. However, as the U.S. recovery took hold and inflation remained surprisingly tame, gold eventually lost momentum. During Obama’s second term, the economy improved, the dollar strengthened, and the urgency to hedge with gold faded. From its 2011 peak, gold prices gradually pulled back, reaching about $1,275/oz by late 20164. By the end of Obama’s presidency, gold had still not fallen back to pre-crisis levels, but much of the early-term gains had been eroded. Overall, Obama’s tenure saw gold rise about 40–45% cumulatively2,with the first-term spike largely defining the era. The key narrative was that gold thrived during the post-crisis stimulus and uncertainty (2009–2011) and then cooled as stability returned (2012–2016).

Donald Trump (2017–2020)

Gold’s journey during Trump’s term was marked by initial consolidation followed by a dramatic rally. In Trump’s first year, 2017, gold actually traded in a range and ended not far from where it started. The reason was twofold: optimism in risk assets and a stronger dollar kept gold in check early on. Trump’s election had come with promises of tax cuts, deregulation, and infrastructure spending – policies that boosted corporate profits and stock markets. Indeed, equities surged in 2017 (the “Trump bump”), and the Federal Reserve continued on a path of gradual rate hikes (tightening policy) given low unemployment. This combination of a hawkish Fed and risk-on investor attitude led the dollar to strengthen and gold to “trade sideways during the first year of Trump’s presidency”4. However, as Trump’s term progressed, uncertainties began to mount. By 2018, geopolitical tensions introduced upside pressure on gold. Notably, Trump’s standoff with North Korea over nuclear tests in 2017–2018 and the saber-rattling in that region made investors nervous4. More significantly, 2018 saw the start of Trump’s trade war with China, with tit-for-tat tariffs that injected uncertainty into global markets4. These developments caused the Fed to pivot – by 2019 the Fed shifted from raising rates to cutting rates in response to trade-war related growth fears. The dollar, which had been firm, began to soften as U.S. yields fell. Gold, which had been quiet, broke out of its range. From mid-2018 onward, gold embarked on a steady climb. Over the four years of Trump’s term, gold gained nearly 50%, rising from roughly $1,210 in Jan 2017 to about $1,840 by Jan 20216 7. The most explosive move came in 2020: the COVID-19 pandemic unleashed a flood of monetary and fiscal stimulus (much of it under Trump’s watch until January 2021) that devalued currencies and created extreme economic uncertainty. The Fed slashed rates to zero and expanded QE massively in 2020, and Congress passed trillions in relief spending – these actions pushed real interest rates deeply negative and the dollar down, catapulting gold to over $2,000/ oz in 20204. Gold hit an all-time high around $2,070 in August 2020 amid the height of pandemic fears and stimulus. It then settled around $1,900 by the end of Trump’s term4. Summing up Trump’s term: gold rose about 50+%, benefiting particularly from his late-term crisis response (pandemic stimulus) and, to a lesser extent, from the safe-haven bid during trade conflicts. Trump’s era illustrated how quickly gold can turn when instability strikes: after a relatively calm 20171, the convergence of trade war, geopolitical risks, and a global health crisis made it one of the best periods for gold on record.

Joe Biden (2021–2024)

Biden’s presidency continued many of the trends set in motion in 2020. Initially, in 2021, as vaccines rolled out and economies reopened, there was optimism about recovery. Gold actually pulled back in the months after Biden’s inauguration – a trend consistent with the pattern that after an election uncertainty subsides, gold often dips (gold was down roughly 6% in the half-year after Biden took office)8. The market’s focus shifted to growth and reopening, which hurt safe-haven demand temporarily. However, by late 2021 and into 2022, a new challenge emerged: surging inflation. The combination of massive fiscal stimulus (including Biden’s American Rescue Plan in March 2021), ultra-low rates, and supply-chain bottlenecks led to the highest U.S. inflation in four decades by 2022. This initially helped gold, as investors bought it to hedge against inflation. Yet, the response of central banks – rapid rate hikes – also introduced opposing forces. In a normal scenario, sharply higher interest rates and a strong dollar would push gold down (since bonds/yields become more attractive). Indeed, one might have expected gold to struggle in 2022 as the Fed hiked rates from near-zero to over 4%. And for a time, gold did stagnate around the mid-$1,800s. However, geopolitics once again intervened to support gold: Russia’s invasion of Ukraine in February 2022 created a seismic geopolitical shock4. The war sparked runs on commodities and a rush into safety, sending gold briefly back over $2,000/oz in March 2022. Moreover, the sanctioning of Russia led to unforeseen second-order effects – notably, central banks (including adversaries like China and Russia) accelerating their move away from the dollar towards gold, as mentioned earlier2. Then, in 2023, another geopolitical crisis – the Middle East war – further buttressed gold’s appeal. By late 2023 and into 2024, gold was on a clear uptrend, even as the Fed was still holding rates high. It became evident that gold was benefiting from a confluence of factors in Biden’s term: lingering inflation (U.S. CPI was ~6.5% at end-2022 and ~3% by end-2024), negative real yields for much of the period, and constant geopolitical uncertainty. As a result, gold set new nominal highs during Biden’s tenure. By October 2024 (just before the election), gold reached ~$2,600/oz – a record at the time4 – and then ~$2,790/oz in the days right before the 2024 vote1. From Biden’s inauguration in Jan 2021 (gold ~$1,840) to late 2024 (gold ~$2,650), the price increased roughly +40%, despite the headwind of higher interest rates. Much of that gain occurred in 2022–2023 during the twin storms of inflation and war. By the end of 2024, as we’ve described, gold was even higher. Thus, under Biden, gold continued to rise, roughly in line with the pace seen under Trump, reflecting that the extraordinary events of these years (pandemic aftermath, war, inflation) heavily influenced gold more than the change in administration itself. One contrast to note is that while Trump often publicly cheered for low rates and a weaker dollar (favorable for gold), Biden’s administration took a more traditional approach (allowing the Fed independence to fight inflation, and a strong dollar policy in rhetoric) – yet external events overtook those policy differences, and gold climbed regardless.

It’s clear from the above that gold’s price does not move in a vacuum; it responds to a mix of economic policies and exogenous shocks that tend to coincide with different presidencies. Obama’s period was defined by economic crisis and recovery, Trump’s by trade conflicts and a pandemic, and Biden’s by inflation and war – gold performed strongest in the crisis phases of each (2009–11, 2019–20, 2022–24 respectively). Notably, gold reached new record highs in both Trump’s and Biden’s time in office (exceeding the 2011 peak), underscoring how the last few years of geopolitical upheaval and monetary response have been especially conducive to gold’s rise. By focusing on just the last six months, we saw a microcosm of these forces at play, with Trump’s influence (tariffs, politics) intersecting with the Biden- era backdrop (inflation, war). The comparative takeaway is that each administration’s actions and the crises they face leave an imprint on gold – and investors constantly readjust, using gold as a barometer of uncertainty across political eras.3

Conclusion

In the six-month window of late 2024 through mid-2025, the price of gold in USD has been on a remarkable ride, heavily shaped by the interplay of political events and economic undercurrents linked to the Trump administration’s legacy. Even though Donald Trump was not in office for much of that period, his influence – through policies set in motion during 2017–2021 and through his dramatic re- entry into politics – had a palpable effect on market psychology and expectations. Gold’s ascent to record highs reflects a confluence of legacy factors (tariffs, deficits, polarization) and new shocks that together created a climate of uncertainty. Inflation concerns (fueled partly by memories of Trump’s trade war and stimulus, and partly by current events) and shifting interest rate policies set the stage for gold’s rise. Geopolitical tensions – from Ukraine to the Middle East – added fuel to the fire, as did the crescendo of political risk around the contentious 2024 U.S. election. By acting as the ultimate hedge against uncertainty, gold attracted robust demand and its price climbed accordingly1.

Yet, the past few months also demonstrated gold’s responsiveness to positive developments. When fears ebbed – for example, with the announcement of trade deals reducing some of Trump’s tariff overhang – gold modestly retreated, showing that it is not a one-way bet. Going forward, the gold market will continue to monitor the fallout (or wind-down) of Trump-era policies: Will tariffs on China be rolled back or doubled down? Will fiscal discipline return or will debt grow unchecked? How will Trump’s foreign policy stance in his new term alter global stability? These open questions ensure that the Trump factor remains intertwined with gold’s outlook.

In comparative perspective, gold’s behavior in late 2024–25 aligns with its historical pattern of responding to policy regimes and crises. Under Obama, a crisis and QE drove gold up, then recovery cooled it. Under Trump, instability (trade war, then pandemic) drove gold to new heights. Under Biden, inflation and war again lifted gold. In each case, gold proved its value as a barometer of confidence: soaring when confidence in fiat, governments, or peace erodes, and stabilizing when confidence is restored. The last six months encapsulated this dynamic vividly.

In summary, the Trump administration’s impact on gold has been both direct (via policy legacies affecting inflation and trade) and indirect (via the political drama and uncertainties associated with Trump’s leadership). Over the last half-year, gold prices reflected a tug-of-war between fear and hope – fear often traced to Trump-linked disruptions, and hope tied to resolutions of those disruptions. The end result was a gold price that, as of June 2025, stands well above its level from six months prior, testament to the enduring appeal of the yellow metal in an era defined by unpredictability. Gold’s resilience during this period reaffirms why it is considered “the only thing you can trust” when economic and political certainties are in short supply6.

Sources: Recent market reports and analyses from Reuters, S&P Global, Bankrate, and other financial outlets were used to compile the data and insights above. Key source materials include Reuters market news on gold’s reactions to political events1 3, S&P Global’s research on gold’s historical performance by presidency4, and expert commentary on the drivers of gold’s 2024–25 rally5 1. These sources provide an authoritative basis for evaluating how Trump’s policies and the broader macro environment have influenced gold in the last six months. Each citation in the text corresponds to specific data or quotes from these references, ensuring that the analysis is grounded in up-to-date and reliable information.

Citations

1: Gold edges up as US election jitters, Fed policy meeting loom | Reuters

2: Gold price forecasts for 2025: towards new records?

3: Gold falls more than 1% after Trump announces UK trade deal | Reuters

4: A timeline of US presidential terms and gold prices | S&P Global

5: What Top Analysts Say Trump's Second Term Could Mean For Gold Prices | Bankrate

6: Gold Prices Surged During Recent Presidencies - Voronoi

7: Here's How U.S. Elections Impact Precious Metal Prices - Hero Bullion

8: Ballots to Bullion: Examining the US Election's Effect on Gold